At a macro level, 2022 has been a year of ups and downs for the U.S. economy. Supply chain issues are still prevalent. Inflation continues to rise, although some experts suggest it may have peaked. Thirty-year mortgage rates topped a 5% average. Loan applications have dipped week-over-week. And, of course, fuel prices continue to soar, which impacts the wallets of every American.

There are, however, some positives. March’s jobs report released during the first week of April turned in more strong gains and a reduction of the national unemployment rate to 3.6%. Home values continue to rise, with demand remaining strong. What’s more, data from March, which was released in April, showed a rise in new housing permits. This is widely considered among the best leading indicators of a strong economy.

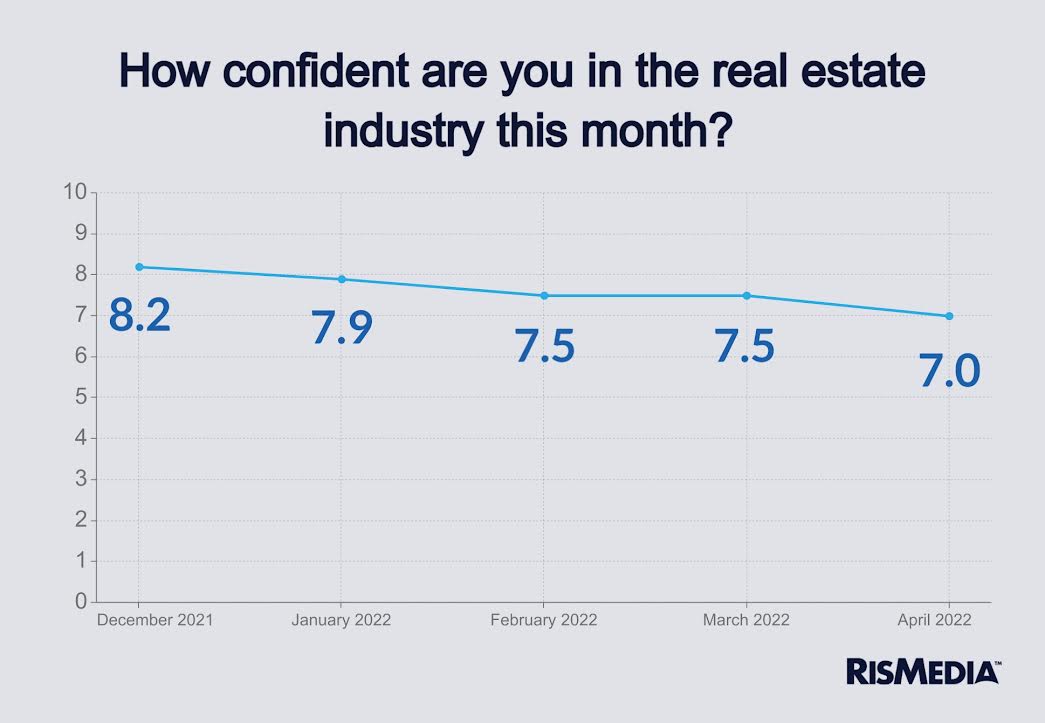

Bottom line, the economy is a mixed bag right now that’s rife with uncertainties, including influences beyond our control, such as Russia’s invasion of Ukraine. This has no doubt had an impact on RISMedia’s monthly Broker Confidence Index (BCI), which reached its lowest score since it began in December 2021.

Our cohort of respondents tallied a BCI score of 7.0 in April (out of a maximum of 10). This is down from 7.5 during the previous two months, and down from 8.2 in December 2021. The data reflect a clear downward trend, and brokers were candid about why they’re less confident than they were at the close of 2021.

Most respondents who offered additional comments cited three major factors influencing their confidence in residential real estate: interest rates, inflation and a lack of inventory. This isn’t exactly a revelation to real estate pros, however. Coming into 2022 most within the industry knew these were core issues.

Still, some are very optimistic due to the sustained demand for housing.

“I think the market will continue to be strong through the balance of this year,” said Fern Karhu, broker/owner at RealtyConnectUSA in Woodbury, New York. “I think this market is very different than other markets we’ve been in when mortgage rates started to rise, because of the COVID-19 factor. People now have more flexibility and the ability to work remotely which is what’s driving the suburban market.”

“Current pending contracts are still very high, albeit lower than last year at this time,” said Shannon Calcines, VP of operations at Florida Executive Realty. “It’s still a very strong seller’s market with short [listing time[ time on market, multiple offers and price increases. It’s the next quarter that will get interesting.”

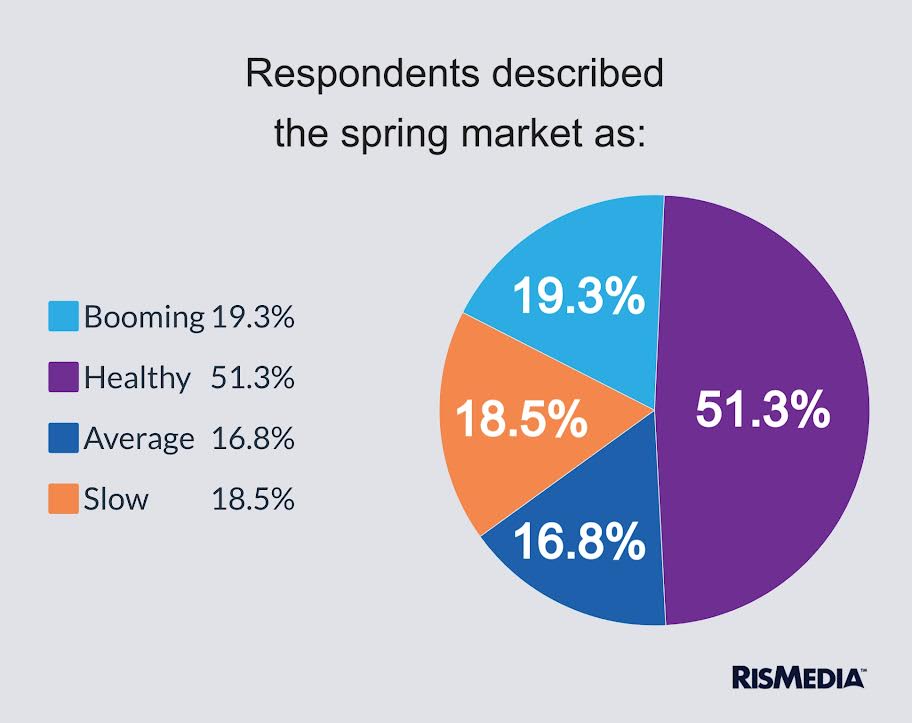

In addition to asking the respondents on their overall confidence, RISMedia also asked how the spring market is shaping up so far. More than half (51.3%) defined their spring market as “healthy.” While 19.3% described it as “booming.” Slightly fewer (18.5%) described it as “slow.” And the fewest number of respondents (16.8%) described it as “average.”

The upshot is that despite a dip in confidence, most brokers are seeing results and have an average to high level of confidence, despite some of the very real headwinds they currently face. However, one respondent warned that even though it’s important to stay focused on the now, it’s even more critical to think long term.

I’m already thinking about the third quarter and 2023. That’s where a healthy mindset will be to survive what’s coming,” said David Kahler, broker/owner and team leader of The Kahler Team at Keller Williams Realty Black Hills in Rapid City, South Dakota.

Caysey Welton is RISMedia’s content director. Email him your real estate news ideas at cwelton@rismedia.com.

Caysey Welton is RISMedia’s content director. Email him your real estate news ideas at cwelton@rismedia.com.

The post Broker Confidence Continues to Decline Month-Over-Month appeared first on RISMedia.