How Real Estate Team Leaders Can Gain a Competitive Edge

While there are numerous factors that go into leading a successful real estate team, one that you absolutely must utilize is a value proposition. Identifying your value proposition and putting it into action will make your business stand out and keep your agents happy, productive and loyal. It’s an essential component in taking your team […]

NAR’s Bryan Greene Joins Third Way to Discuss Solutions to the Housing Supply and Affordability Crisis

Greene highlighted policy proposals NAR is pursuing to make homeownership accessible to more people and outlined supply solutions that can be activated immediately. www.nar.realtor – Fair Housing

Instant Reaction: Mortgage Rates, April 14, 2022

Mortgage rates surged to 5% for the first time in over a decade (since February 2011). Elevated inflation continues to push up mortgage rates. www.nar.realtor – Research

Commercial Weekly: Modest Rent Differences and Rising Construction Cost are Headwinds for Office-to-Residential Conversions in Major Metro Areas

The conversion of vacant office space for residential use faces hurdles from rising rental and construction costs. www.nar.realtor – Research

Clever Cures for the Worst of Winter

Cold weather can keep homeowners cooped up inside for months, so why not use that time to take on some quick and easy DIY home repairs. www.nar.realtor – Real Estate Story Ideas

Second Century Ventures, the Strategic Arm of the National Association of Realtors®, Appoints Peter Schravemade to Helm of REACH Australia Tech Program

REACH Australia Appoints New Managing Partner Second Century Ventures, the strategic venture arm of NAR, has appointed Peter Schravemade as managing partner of REACH Australia. Media Contact: Spencer High 202-383-1051 Technology

A Culture of Training: The Secret to a High-Producing Real Estate Team

Many successful agents start a real estate team with enthusiasm and drive, but then face confusion and uncertainty as they get going. How do you go from being a high producer to a strong leader? How can you feel confident that your agents will treat people as you would, establish a strong referral network and […]

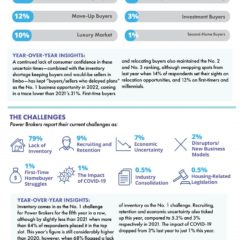

Power Brokers Brace for Changing Conditions

While their collective sales volume was a staggering $ 2.4 trillion-plus in 2021, the Top 1,000 brokers ranked in RISMedia’s 2022 Power Broker Report are facing a very different landscape as this year progresses. According to the results of RISMedia’s annual Power Broker Survey, total sales volume for the top 1,000 firms in 2021 increased […]

Commentary: 8 Things Your Real Estate Clients Expect From You

Without accounting for your real estate clients’ common needs and expectations, you might be underperforming and risk losing their business. Here are eight things your real estate clients are expecting from you as their real estate professional: Be available. Make yourself available to your clients as often as possible. Even if you cannot answer right […]